Variable Costs Accounting Calculation . total variable cost = total quantity of output x variable cost per unit of output. variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. variable costs can add a layer of unpredictability to running your business. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). This article is tax professional approved. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. The variable cost per unit will vary across profits. But with a firm grasp of the variable cost formula and. Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. variable cost formula.

from www.educba.com

variable cost formula. The variable cost per unit will vary across profits. But with a firm grasp of the variable cost formula and. This article is tax professional approved. total variable cost = total quantity of output x variable cost per unit of output. variable costs can add a layer of unpredictability to running your business. Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product.

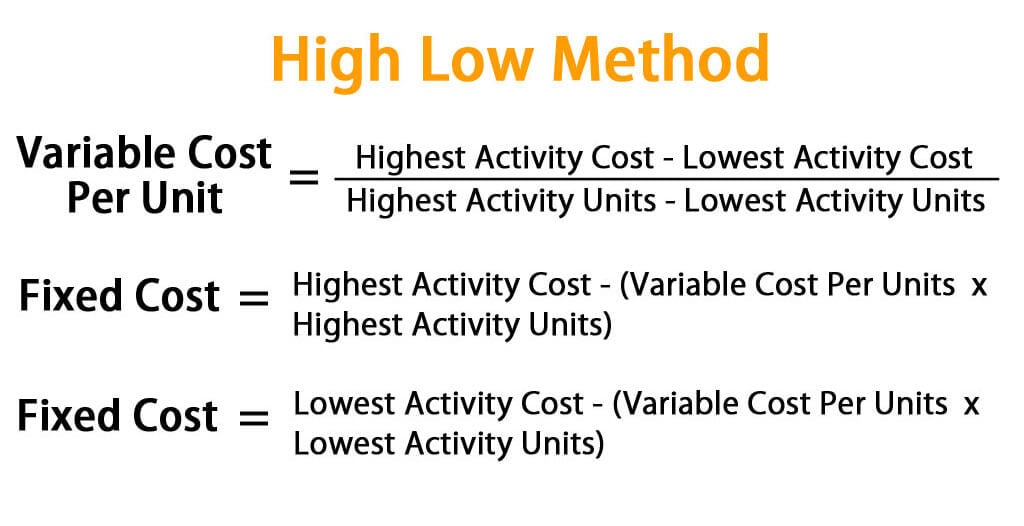

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

Variable Costs Accounting Calculation This article is tax professional approved. variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. This article is tax professional approved. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). The variable cost per unit will vary across profits. variable cost formula. variable costs can add a layer of unpredictability to running your business. Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. But with a firm grasp of the variable cost formula and. total variable cost = total quantity of output x variable cost per unit of output.

From www.exceldemy.com

How to Calculate Cost per Unit in Excel (With Easy Steps) ExcelDemy Variable Costs Accounting Calculation variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. The variable cost per unit will vary across profits. This article is tax professional approved. Since a company’s total costs (tc) equals. Variable Costs Accounting Calculation.

From www.educba.com

Variable Costing Formula Calculator (Excel template) Variable Costs Accounting Calculation This article is tax professional approved. variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). But with a firm grasp of the variable cost formula and. variable costs can add a. Variable Costs Accounting Calculation.

From www.zippia.com

How To Calculate Total Variable Costs Examples And Formulas Zippia Variable Costs Accounting Calculation Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. variable cost formula. variable costs can add a layer of unpredictability to running your business. This article is tax professional approved. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). The variable cost per. Variable Costs Accounting Calculation.

From www.investopedia.com

Variable Cost What It Is and How to Calculate It Variable Costs Accounting Calculation The variable cost per unit will vary across profits. Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. total variable cost = total quantity of output x variable cost per unit of output. variable costing is a cost accounting method for calculating production expenses where only variable costs are included. Variable Costs Accounting Calculation.

From www.slideshare.net

Variable Cost Accounting Variable Costs Accounting Calculation variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). But with a firm grasp of the variable cost formula and. variable cost formula. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable costing is a cost accounting. Variable Costs Accounting Calculation.

From online-accounting.net

3 Ways To Calculate Variable Costs Online Accounting Variable Costs Accounting Calculation Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable cost formula. The variable cost per unit will vary across profits. variable costs can be calculated through total. Variable Costs Accounting Calculation.

From www.akounto.com

Fixed Cost Definition, Calculation & Examples Akounto Variable Costs Accounting Calculation The variable cost per unit will vary across profits. variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. This article is tax professional approved. total variable cost = total quantity of output x variable cost per unit of output. variable cost formula. variable costing is. Variable Costs Accounting Calculation.

From exoirtqpr.blob.core.windows.net

Variable Costs In Accounting at Linda Blair blog Variable Costs Accounting Calculation total variable cost = total quantity of output x variable cost per unit of output. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). The variable cost per unit will. Variable Costs Accounting Calculation.

From www.vrogue.co

Variable Costs Definition Calculation And Examples Br vrogue.co Variable Costs Accounting Calculation But with a firm grasp of the variable cost formula and. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). total variable cost = total quantity of output x variable cost per unit of output. The variable cost per unit will vary across profits. Since a company’s total costs (tc) equals the. Variable Costs Accounting Calculation.

From www.myaccountingcourse.com

What is Average Variable Cost (AVC)? Definition Meaning Example Variable Costs Accounting Calculation This article is tax professional approved. variable cost formula. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable costing is a cost accounting method for calculating production expenses. Variable Costs Accounting Calculation.

From investinganswers.com

Variable Cost Examples & Definition InvestingAnswers Variable Costs Accounting Calculation total variable cost = total quantity of output x variable cost per unit of output. The variable cost per unit will vary across profits. Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. variable costs can add a layer of unpredictability to running your business. variable costs can be. Variable Costs Accounting Calculation.

From mailchimp.com

A Guide To Variable Costs Formulas + Tips Mailchimp Variable Costs Accounting Calculation variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). variable cost formula. The variable cost per unit will vary across profits. variable costs can add a layer of unpredictability to. Variable Costs Accounting Calculation.

From avada.io

How To Calculate Variable Cost? Guide, Examples and Extra Tips Variable Costs Accounting Calculation variable costs can add a layer of unpredictability to running your business. variable cost formula. The variable cost per unit will vary across profits. total variable cost = total quantity of output x variable cost per unit of output. But with a firm grasp of the variable cost formula and. variable costs can be calculated through. Variable Costs Accounting Calculation.

From ondemandint.com

Variable Cost Definition, Examples & Formula Variable Costs Accounting Calculation variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. variable cost formula. The variable cost per unit will vary across profits. This article is tax professional approved. But with a firm. Variable Costs Accounting Calculation.

From www.youtube.com

Fixed and Variable Costs (Cost Accounting Tutorial 3) YouTube Variable Costs Accounting Calculation variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. This article is tax professional approved. variable cost formula. Since a company’s total costs (tc) equals the sum of its variable (vc). Variable Costs Accounting Calculation.

From learn.financestrategists.com

Cost Allocation Definition Types Methods Process Variable Costs Accounting Calculation variable costs can add a layer of unpredictability to running your business. total variable cost = total quantity of output x variable cost per unit of output. Since a company’s total costs (tc) equals the sum of its variable (vc) and fixed costs (fc),. variable costing is a concept used in managerial and cost accounting in which. Variable Costs Accounting Calculation.

From learnbusinessconcepts.com

Variable Cost Explanation, Formula, Calculation, Examples Variable Costs Accounting Calculation variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. But with a firm grasp of the variable cost formula and. The variable cost per unit will vary across profits. variable costs can be calculated through total variable costs (tvc) or average variable costs (avc). total. Variable Costs Accounting Calculation.

From www.pinterest.com

Image titled Calculate Variable Costs Step 9 Economics Lessons, Fixed Cost, Variables Variable Costs Accounting Calculation variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. variable costing is a cost accounting method for calculating production expenses where only variable costs are included in the product. total variable cost = total quantity of output x variable cost per unit of output. The. Variable Costs Accounting Calculation.